Most companies say they want to grow. Far fewer budget like it.

Growth Requires Budgeting Against Future Revenue

If your marketing budget is built off last year’s revenue, you’re not planning for growth—you’re planning to defend your current share. Holding share and taking share require different levels of investment. Growth means tying spend to projected revenue, not historical performance.

Budgeting against next year’s revenue means aligning marketing investment to projected growth, not previous performance. Companies that do this are planning to gain market share, not simply maintain it. Marketing becomes a growth system tied to opportunity, rather than a fixed cost anchored to last year’s results.

This isn’t a philosophical debate. It’s math.

Growth doesn’t happen at category-average visibility, especially as marketing itself is going through a generational shift. Running last year’s playbook with last year’s budget doesn’t create lift; it creates stagnation.

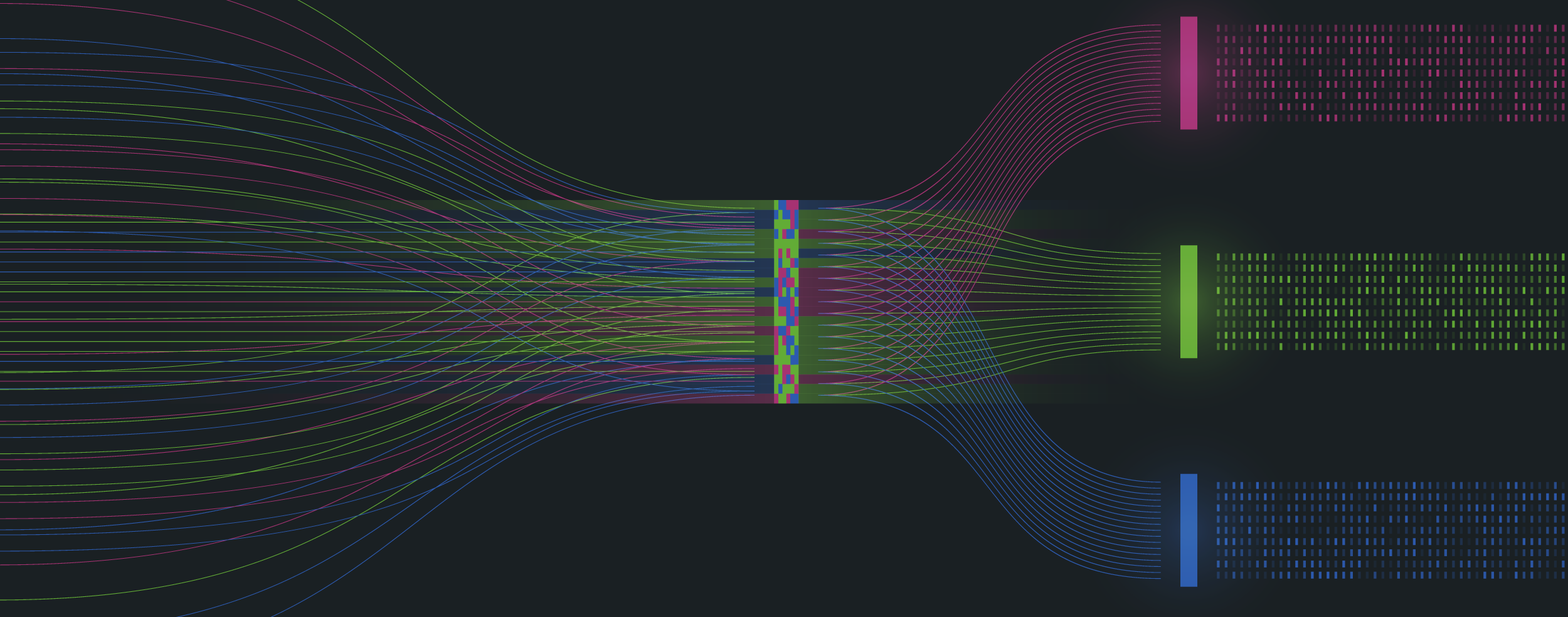

Real growth requires breaking from “rinse and repeat” planning and funding the evolution of the stack. That means moving beyond legacy lead gen tactics and into AI-enabled research, automation, and high-scale personalization tools like Clay. These aren’t nice-to-haves. They’re core infrastructure. While some teams are still manually chasing outdated data, others are compounding efficiency. If your budget doesn’t allow for this kind of testing and adoption, you’re not standing still—you’re falling behind.

In industrial markets, where we do a lot of our work, demand is often flat. There’s limited new volume. Growth comes from taking business from competitors. The math is simple: either you take share, or they take it from you.

That only happens if you out-invest competitors at the points of influence—awareness, preference, consideration, and conversion. Sales and marketing, together. If your strategy and budget mirror last year’s, you’re using yesterday’s effort to chase tomorrow’s goals. That’s not a growth model. It’s a preservation model.

The benchmarks back this up. Across industries, companies that grow spend above maintenance levels. The ranges vary, but the logic doesn’t.

What Growth Benchmarks Show Across Industries

Category | Share-Holding (Status Quo) Spend | Share-Gaining (Growth) Spend | Why It Matters |

Industrial Manufacturing | 3–6% | 6–10% | Growth requires breaking out of pure sales-driven acquisition and expanding reach into in-market buyers. |

Trade Show Organizers | 8–15% | 15–25% | Attendance and exhibitor growth don’t happen at “maintenance levels.” Marketing is the lever. |

Professional Services | 8–12% | 12–20% | Visibility drives trust; trust drives pipeline. Growth-mode firms spend to accelerate reputation and lead flow. |

This approach also scales with performance. If revenue underperforms, forecasts and spend adjust. If revenue accelerates, investment keeps pace. Marketing shifts from a fixed cost to a semi-variable one tied to opportunity.

What executives want is confidence. CFOs don’t object to proportional spend, they object to disconnected spend. And revenue doesn’t move the moment a campaign launches. There’s a lag.

How Growth Leaders Measure Confidence Before Revenue Moves

That’s why growth leaders track leading indicators that clearly connect investment to future revenue:

• Faster, more relevant follow-up with high-intent leads

• Increased traffic and engagement from target markets

• Greater reach into the right accounts

• Stronger sales engagement and faster movement through the funnel

• More frequent, higher-quality sales conversations

When these move early and consistently, confidence goes up and budget conversations get easier.

It’s a practical framework for teams serious about aligning growth objectives, budgets, and execution.